2022 Review: Back to Reality

2022 was a challenging year for financial markets, ending with stocks returning -18% and bonds returning -13%. Although diversifying into other asset categories, including commodities and infrastructure, helped dampen the impact of the negative returns, market investors found few places to generate positive returns.

Kathryn Mawer, our Outsourced Chief Investment Officer (OCIO) Fund Evaluation Group (FEG) Investment Advisor.

While FEG believes there may still be more volatility and negative returns to come, we believe the 2022 decline helped the market “reset” back to reality. For investors, this should mean a more measured pace of growth moving forward.

What does that mean? Let’s look at these two topics:

- The key drivers behind 2022 negative stock and bond returns

- Market expectations as we look forward

The drivers behind 2022 negative stock and bond returns

Negative returns were driven primarily by inflation and the corresponding actions of central banks, including the Federal Reserve. As inflation soared to multi-decade highs, the Fed increased borrowing rates from 0.1 percent at the beginning of 2022 to 4.3 percent by the end of year.

2022’s sharp reversal in policy stance, from ultra-accommodative to restrictive, was a headwind for stocks and bonds.

- With stocks, inflation drives up the prices of inputs in the production process, like raw materials and labor. This in turn results in higher expenses and compressed margins.

- With bonds, inflation erodes the purchasing power of the bond’s future cash flows, essentially reducing the real return on the bond.

The actions of the Fed (and other central banks) have reset stock valuations so that now, those valuations are close to historic norms. Interest rates are also back to near normal long-term levels after more than a decade of being well below normal. You do not need to look further than mortgage rates to see this. Today’s 30-year fixed-mortgage rates are at 6.5 percent; the historical average is 6.4 percent.

Market expectations as we look forward

The declines across most asset categories in 2022 helped reset the valuations to their historic norms. This has the effect of increasing future return expectations.

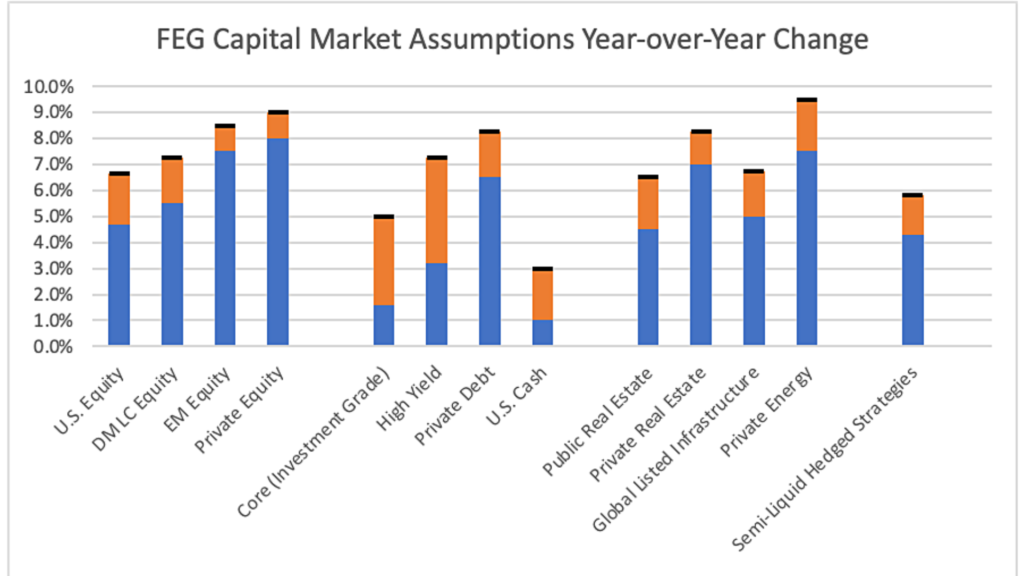

Each year, FEG’s team of research professionals puts together long-term return expectations for many asset categories in the market, including stocks (equities) and bonds (fixed income). For example, in 2022, FEG expected U.S. stocks to return 4.7 percent over the course of the following seven to 10 years. At the start of 2023, we have increased our expectations and believe returns should be closer to 6.6 percent – reflecting nearly a 2 percent absolute change.

These return expectations are long-term – typically seven to 10 years. In the short term, we may experience continued declines and volatility. As a result, FEG is positioning the Community Foundation’s portfolio conservatively. We continue to hold stocks but are not adding to this position yet. During the fourth quarter 2022, we added more high-quality bonds in the form of U.S. treasuries, because short-term returns are highly attractive. We also continue to invest in other, diversified strategies to help balance the portfolio.

The Community Foundation prudently invests charitable funds so they may strengthen the community for current and future generations, carrying out our generous donors’ wishes to impact their communities and make a difference in the lives of others. Our investment strategy is managed by our Outsourced Chief Investment Officer (OCIO) Fund Evaluation Group (FEG) Investment Advisors, whose advisors are working with our volunteer investment committee members, who are local experts in investment and finance. Learn more about our investment strategy.

Leave a Comment